Dr. Raziel Obeng-Okon, Chief Executive Officer of CIDAN Investment Limited, on Friday said the new petroleum price build up as announced in the 2015 budget, will impact negatively on the stock levels of the Bulk Distribution Companies (BDCs).

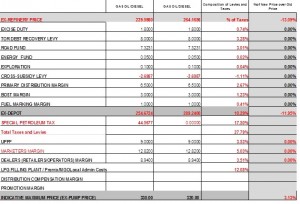

He explained that as per the New Petroleum Price Build Up which became effective on November 20, Government had reduced the Ex-Refinery Price on Super from GH₡2.64 to GH₡2.28 per litre, representing a reduction of GH₡0.35 or about 14 per cent decline.

Dr Obeng-Okon in an interview with the Ghana News Agency on the New Price Build up noted that the introduction of the Value Added Tax (VAT) or special petroleum tax of GH₡0.45 per litre representing 17.5 per cent tax on the Ex-Depot Price.

He said the 14 per cent reduction has manifested in a decline of the Ex-Depot price from GH₡2.98 to 2.62 per liter or 12.04 per cent.

The reduction in the refinery price has been compensated by the introduction of the new VAT of 17.5 per cent on the Ex-Depot price leading to only a marginal increase in the final price from GH₡3.29 to GH₡3.39 representing only an increase of GH₡0.10 or only about 3.04 per cent per liter of Super.

The analysis also holds for Diesel, the Ex-Refinery Price decreased from GH₡2.64 to GH₡2.29 per liter representing a decrease of about GH₡0.35 or 13 per cent.

The Diesel price resulted in a reduction of the Ex-Depot price by 11.95 per cent which is lower than that of Super 12.04 per cent due partly to the impact of cross subsidy levy in the pricing of Diesel.

Explaining the implications of the New Petroleum Price Build Up, Dr Obeng-Okon said there is too much tax on Petroleum Products.

For Super and Diesel, Ghanaians were already paying 12.87 per cent and 10.29 per cent of the Ex-Depot Price as levies covering Excise Duties, TOR debt recovery levy, Road Fund, Energy Fund, Exploration Levy, Fuel Marking Margin.

Adding the new VAT of 17.5 per cent increases the total levies and taxes to 30.37 per cent and 27.79 per cent for Super and Diesel respectively.

He said additional distribution cost accounts for 11.73 per cent and 12.08 per cent for Super and Diesel respectively are added to arrive at the Final Ex-Pump Price.

Dr Obeng-Okon explained that the cost of levies, VAT and distribution margins sum up to 42.10 per cent and 39.87 per cent on the prices of Super and Diesel respectively.

He noted, however, that Bulk Distribution Companies (BDCs) will suffer as a result of the price reduction at the Ex-Refinery Price level on their existing stocks.

“Total revenue loss for Super and Diesel shall be 13.58 per cent and 13.09 per cent respectively, but the impact will be dependent on the level of stocks at each BDC.

“This will run into several millions of cedis, and impact negatively on cash flows. Government needs to work out a modality to arrest price shocks to key market players, like the BDC, to ensure sustainability of their operations,” he said.

He noted that marketers and dealers margins continue to shrink in real terms – the Marketers Margin as a percentage of the final price for Super has reduced from 3.90 per cent to 3.78 per cent for every cedi sold while Diesel has reduced from 4.01 per cent of every cedi sold to 3.88 per cent.

The Dealers Margin for Super on the other hand has reduced from 2.72 per cent to 2.64 per cent on every cedi sold while the diesel has reduced from 2.79 per cent to 2.71 per cent on every cedi sold.

“The Marketers, are therefore, being squeezed out of business by this new pricing policy,” he said.

Dr Obeng-Okon noted that the OMCs have merely become levies and tax collectors for Government, without their business considerations taken into account.

“Both the Marketers and Dealers Margins need to improve for the OMCs to survive in business.

Government must keep a close eye on the distribution margins before it is too late,” he said.

On the impact on the consumer, Dr Obeng-Okon said the increase is ‘very cunning and tricky,’ because the increase of 17.5 per cent VAT has been compensated by the reduction of the Ex-Refinery Price of about 13.58 per cent and 13.09 per cent for Super and Diesel respectively.

“Leading to a net increase of only about 3 per cent for the final consumer to absorb,” Dr Obeng-Okon noted.

He said ordinarily, the three per cent should not lead to significant increases in the general prices of goods and services…. “However the new price of fuel is only feasible and sustainable because the crude price is currently at a record low.

“….the crude oil prices were down almost another 2.8 per cent to below $75 a barrel after peaking at 108 dollars per barrel earlier this year”.

He said conventional insight or the general belief is that the crude oil prices will continue to linger and drift slightly downward in 2015.

“But that may not be the case, we could be in for a price shock that may send oil prices back over $100 per barrel, and maybe even as high as $150 – a peak it last touched in 2008.

“To this end, government is gambling with the implementation of the VAT on fuel prices, because crude oil price shocks may lead to significant increases which government may not be able to pass on to the final consumer,” he concluded.

Source: GNA