Parliament to sanction institutional defaulters

Parliament would by October ending this year sanction institutions that fail to comply with the recommendations of the Public Accounts Committee (PAC).

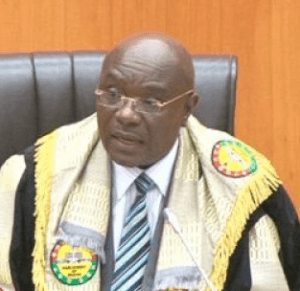

This follows a directive given on Thursday by the Speaker of Parliament, Edward Doe Adjaho, instructing 25 institutions named in the PAC’s report for financial irregularities to submit to the house, a report on the implementation of the Committees report or face full sanctions by October 15, 2015.

The directive is as a result of an application made by the Chairman of the PAC and MP for Dormaa Central, Kwaku Agyemang Manu, praying the Speaker to ensure that the House obtained full financial accountability of public funds from the Executive and other public office holders.

Mr Agyemang Manu was there to present the Committee’s report of the Auditor-General on the Public Boards, Corporations and other statutory institutions for December, 2010 and 2011, findings of which, revealed significant irregularities in the financial accounts of the 25 institutions.

He told the Speaker that the House ought to sanction public officials for ineptitude resulting in the loss or misappropriation of public funds.

A summary of the financial irregularities for the period as gleaned in the report, arising from outstanding debts, cash, payroll, contract, procurement, stores and tax anomalies, amounting to GH¢2 billion, is attributed to weak internal controls, lack of supervision, failure to sanction wrong doers, lack of policies, improper contract management and the non-adherence to rules and regulations.

The Speaker in response to the PAC’s request, said in keeping with the Legislature’s constitutional role of keeping an eye on the public purse, henceforth institutions that appeared before the Committee would be required to present implementation reports on recommendations or face the rigours of the law.

The institutions named in the report include the Ghana Cocoa Board (COCOBOD), the Cocoa Marketing Company (Ghana) Limited, the Social Security and National Insurance Trust (SSNIT), the Electricity Company of Ghana (ECG), the National Petroleum Authority (NPA), the Ghana Trade Fair Company and the Ghana Standards Board.

Others include, the School of Public Health, College of Health Science of the University of Ghana, School of Nursing, College of Health Sciences of the University of Ghana, the Noguchi Memorial Institute for Medical Research, the University of Professional Studies, the Accra Polytechnic, the University of Mines and Technology, the University of Cape Coast and the National Board for Professional and Technician Examination.

The rest are the Ghana Science Association, Abibigroma Theatre Company, the Copyright Office, the Legal Aid Scheme, Law Reform Commission, State House Company Limited, the Electoral Commission, the State Enterprise Audit Corporation and the Economic and Organised Crime Office.

Significant among the irregularities were those recorded in the audited accounts of the COCOBOD, SSNIT, ECG and the NPA.

In the instance of the COCOBOD, the company had not recovered some GHC3.6 million owed it by five Licensed Buying Companies at the end of the 2010 financial year, which the Committee insisted had the tendency to negatively affect the smooth running of the Boards’ operations.

The COCOBOD also did not pay dividend into the Consolidated Fund in 2010 despite the fact that it made profits to the tune of GHC158, 570,319. It emerged that the last time the COCOBOD paid dividends into the Consolidated Fund was during the 2003/2004 financial years.

The management of COCOBOD has been applying its profits to the construction of “cocoa roads’ and towards investment to enhance the sustainability of the sector.

The Committee recommended that the Finance Committee of Parliament should critically look at COCOBODS profits application policies to ensure efficiency, effectiveness and value for money.

On the SSNIT, the Committee was apprehensive at the continuous lack of profitability of the institution’s investments that were draining contributor’s financial resources, noting particularly the Trust Hospital, The SSNIT Guest House and the Bessblock Limited that had been incurring consistent losses.

The Committee recommended that SSNIT review its non-performing investments in order to identify the cause of the losses and take appropriate measures to stem them.

The Committee was also worried that a loan of GHC3 million granted by the SSNIT to Ghana Agro Food Processing Company (GAFCO) since November 2004 remained unpaid at the time of the 2010/2011 audits.

But SSNIT explained that the amount constituted an equity loan advance to GAFCO on October 22, 2004 pending the definitive determination of the value of GAFCO for the purpose of SSNIT acquiring 40 percent equity in the company.

The loan was converted into equity in 2010 when the value of GAFCO was finally determined.

Source: GNA