Ghana’s insurance industry has to be exploited for development – Amissah-Arthur

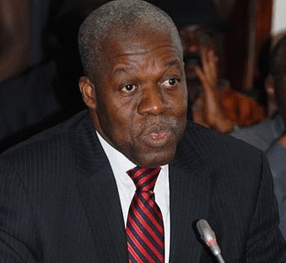

Vice President Kwesi Amissah-Arthur has stated that the potential of the country’s insurance industry was great and has to be fully exploited for the development of the economy.

He also challenged the professionals in the insurance industry to do more to enhance the growth of the sector.

Vice President Amissah-Arthur made the statement when he launched the 25th anniversary celebration of the National Insurance Commission (NIC) in Accra.

The anniversary which is on the theme: “Advancing the frontiers of Insurance in Ghana” was attended by industry players, including insurance companies, insurance brokers, the Police, National Road Safety Commission, among others.

The event was also used to unveil a new NIC logo as well as the re-naming of NIC building after Mr Samuel Appiah-Ampofo, a former Insurance Commissioner, who is credited for bringing major reforms into the insurance industry in Ghana.

Vice President Amissah-Arthur stated that the government was committed to sustaining and accelerating the progress made in the financial sector by pursuing policy initiatives and measures that were aimed at improving the sector and the insurance industry in particular.

He said that the financial services sector has achieved significant growth since the structural and policy reforms in the 1980s and 1990s.

He said the reforms led to reduction of the state domination and opened the sector to serious competition.

He said the growth of the financial services sector over the last decade has exceeded every sector of the Ghanaian economy, including even the petroleum driven industrial sector.

Vice President Amissah-Arthur also stated that the banks continue to dominate the sector and as at June this year the commercial banks held 75 percent of the assets of the financial service industry, while the insurance sector held less than five percent of the assets.

“This shows how much work the people in the insurance industry has to do to catch-up with the banks,” he added.

Vice President Amissah-Arthur further stated that the banks seemed to have exploited the opportunities in the financial service sector more consistently than the insurance industry.

He said over the past three decades the Ghanaian economy has expanded combining improvement with macro-economic management with strong export growth and progress in social interventions.

He said with the commencement of petroleum production and export has created a new demand for financial services and products.

He therefore expressed the hope that in the coming years the financial services sector would be able to address the needs of the changing economy.

Vice President Amissah-Arthur also charged the NIC to take the lead in marketing and sensitizing the population on the need to insure against natural and man-made disasters including floods, markets fires and accidents.

He said the informal sector, mostly the self-employed, artisans, traders, had been largely ignored by the insurance companies and only targeting the formal sector employees who are captured on the national data base therefore creating a gap on the potential social value of insurance and transaction cost of insurance, adding that these are widening for those in the poorer segment of the society.

He said the contribution of insurance to poverty alleviation and improvement in the welfare of the poor was of considerable importance to the country’s economy.

Ms Lydia Lariba Bawa, Commissioner of Insurance, said the NIC had worked through the years under the leadership of various Commissioners and board members to bring the organization to its current status.

She said the NIC was implementing forward looking supervisory role that focuses on the identification and mitigation of risks.

She said the Commission had collaborated with some development partners to significantly improve access to insurance for Ghanaians.

Ms Bawa said over the last two years the Commission had taken bold steps to improve the liquidity of insurance companies in order to ensure their ability to pay claims adequately and promptly.

She said the modest gains have been chalked through the hard work, support and dedication of their valued stakeholders.

Source: GNA