Bank of Ghana not keeping funds belonging to microfinance institutions – Narh

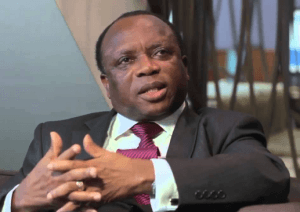

A deputy Governor of the Bank of Ghana has said microfinance companies do not keep their funds with the Bank, and therefore, the central bank is not holding money belonging to customers of institutions facing sanctions from the Bank.

Mr. Narh who was responding to accusations from a section of the public following the revocation of the approval in principle of some 70 prospective microfinance companies that the Bank was holding deposits of customers, stated that microfinance companies kept their reserves with commercial banks and not the central bank.

He told journalists at a press briefing Friday January 8, 2016 that the are no regulations requiring microfinance companies to keep their funds at the central bank, adding that only commercial banks are mandated to keep their reserves at the central bank.

He indicated also that the actions the Bank is taking are in the interest of the depositors. He wondered why people would deposit money with any institution that promises them about 60 per cent interest a quarter, arguing that even the treasury bill interest rate is currently pegged at about 24 per cent per annum.

He noted that there are currently about 546 licensed microfinance companies doing business in the country.

Asked about what he thinks should be a sustainable interest rate for microfinance companies he said,” minimum 6 per cent and maximum 8 per cent.”

By Emmanuel K Dogbevi