Ghana mid-year budget review reveals revenue shortfall – Moody’s

Ghana’s mid-year budget review shows that all is not well with the economy.

On July 25, 2016, the Ghana government requested for a supplementary budget of GH¢1.8 billion to finance expenditure.

He argued that the supplementary budget was necessitated by both domestic and global developments. The Minister indicated a cash deficit of 2.5 per cent for the first five months of 2016.

Moody’s citing the cash deficit of 2.5 per cent of GDP, indicates that the result exceeds the 2.2 per cent budgeted for the period and reflects the challenges the country faces in generating revenues.

“Except for taxes on domestic goods and services, all other tax types as well as non-tax and grants disbursements underperformed their respective budget targets, most of all oil-related revenues,” Moody’s said in comments copied to ghanabusinessnews.com, Friday August 4, 2016.

According to Moody’s, most of the revenue shortfall was offset by lower-than-expected expenditure and arrears clearances, collectively equivalent to 10.6 per cent of GDP – this compares to 11.6 per cent forecast in the budget and 10.9 per cent a year ago.

“The underspend reflected a 0.6 percentage point drop in capital expenditures to 1.1 per cent of GDP in the first five months – the government had forecast 1.7 per cent in budget (1.9 per cent a year before).

The government’s revised deficit target for the end of 2016 is 5.0 per cent of GDP, versus our estimate of 6.1 per cent,” it said.

Moody’s states further that on the domestic financing side, lower-than-budgeted funding from commercial banks has been more than offset by an increase in financing from the Bank of Ghana to GH¢1.634 billion (about $415 million) during the first five months of this year, although this series in the fiscal accounts includes drawdowns of government deposits at the central bank.

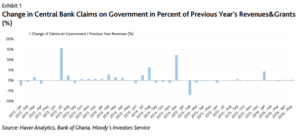

“A more accurate measure of the government’s borrowings from the central bank is the net claims of the Bank of Ghana on the government which, according to the Auditor General’s reports for 2012 – 2014, exceeded the former legal limit of 10 per cent of previous year’s total revenues in each of those years, whereas 2015 saw a net redemption of government borrowings from the central bank by the end of the year,” Moody’s said.

“On August 2, 2016, parliament voted to reduce the legal limit to 5 per cent in the Bank of Ghana Act Amendment, a limit that is higher than the 2 per cent credit line cap with a temporary limit of up to 90 days per year proffered in the January 2016 IMF report. We expect that any borrowing incurred during the course of this year will have to be redeemed by the end of the year in order to comply with the zero central bank financing structural benchmark starting 2016 agreed with the IMF under the three-year Extended Credit Facility (ECF) programme.

“On August 2, 2016, parliament voted to reduce the legal limit to 5 per cent in the Bank of Ghana Act Amendment, a limit that is higher than the 2 per cent credit line cap with a temporary limit of up to 90 days per year proffered in the January 2016 IMF report. We expect that any borrowing incurred during the course of this year will have to be redeemed by the end of the year in order to comply with the zero central bank financing structural benchmark starting 2016 agreed with the IMF under the three-year Extended Credit Facility (ECF) programme.

That said, we expect the adoption of the Bank of Ghana Act Amendment to broadly satisfy the IMF’s prior action requirements for the conclusion of the third review in our central scenario. As a further prior action, the finance minister has also presented the adopted strategy to restructure and redeem legacy debts from the VRA power utility and from the TOR refinery to the banking system via the energy levies introduced in January 2016 for this purpose,” it added.

Moody’s believes that the government’s strategy involves the repayment of an amount of GH¢2.2 billion (about $550 million) over three to five years, with an upfront payment of GH¢250 million from the same source. The plan also includes interest rate reductions, limits on new VRA debts and the collection of VRA receivables in a debt-service account to prioritize repayment of interest and principal.

“We expect similar restructurings of remaining legacy utility debts to ultimately increase the banking system’s ability to extend credit to the private and public sectors, and to contain contingent liabilities for the government,” Moody’s said.

By Emmanuel K. Dogbevi

Copyright © 2016 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.