Ghana needs to break the high fiscal deficit cycle – Razia Khan

Ghana needs to break the cycle of high level of fiscal deficit through institutionalisation of reforms that would make fiscal expansion more difficult.

Ghana needs to break the cycle of high level of fiscal deficit through institutionalisation of reforms that would make fiscal expansion more difficult.

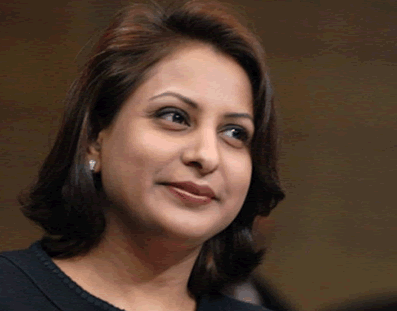

Ms Razia Khan, Chief Economist for Africa Global Research Standard Chartered Bank, who made the call, said there was the need for consensus that fiscal deficit needed to be subject to some rules.

“The shape of that rule could be that the deficit never exceeds three to five per cent of GDP,” she said.

“Where Ghana needs to be is whether IMF or without IMF there is no longer going to be fiscal slippage and it is not going to happen because these are Public Financial Management reforms in place,” she told journalists at a news conference in Accra.

She said last year’s fiscal slippage was such a disappointment because Ghana was under IMF programme and it became clear that something additional was needed like the tightening up of legislation and the broad-based willingness of all parties involve to agree there was never going to be a departure from fiscal discipline otherwise it becomes difficult to break the cycle of debt.

Ms Khan said the debt management so far had been good but warned that there had been times over the years when fiscal deficit seemed to be brought under control only for it to be blown out by uncontrolled expenditure.

On the issue of Ghana, quitting the IMF programme, Ms Khan said investors were going to look for external signal to have confidence or willing to buy Ghanaian government debt but said Ghana would have to show that it was doing enough own its own to institutionalise the reforms, to legislate them and keep them in place.

She said for Ghana to get the confidence of the investors, it was important that the gains so far achieved were consolidated through trust and transparency in the system.

“Debt management gains are for real. It is difficult to see what will move Ghana to be reliant on short-term debt instruments,” she said.

On the banking sector, Ms Khan said for the long term health of the country it was important for the public to have faith in the institutions that have been licensed.

She said they should be meeting capital adequacy requirements and that participants in the economy should have trust and that the regulators would always enforce the level of financial supervision and were in touch with what was going on in the economy.

The regulators must be comfortable with the soundness of the entire banking system so that if they identified institutions that were inadequately capitalised different actions to resolve capitalisation of the institutions should be seen as overwhelmingly positive thing.

Source: GNA