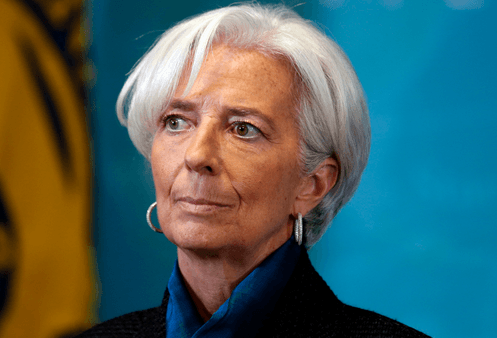

Public debt in half of sub-Sahara Africa reaches 50% of GDP – Lagarde

Concerns are rising over growing public debt in about half of the countries in sub-Sahara Africa. The sharp increase has reached 50 per cent of GDP, according to International Monetary Fund (IMF), Managing Director, Christine Lagarde.

Speaking at the United Nations Economic Commission for Africa (UNECA) in Addis Ababa, Ethiopia, Friday December 15, 2017, Ms. Lagarde expressed concern about the GDP per capita of some countries. She said on a GDP per capita basis, 15 countries on the continent are expected to see a decline this year.

“This encompasses about 40 per cent of the population. And there are concerns on the horizon as well, even as the sun is shining. Indeed, as I have been saying recently, it is when the sun is shining that we have to fix the roof. One concern we see is a sharp increase in public debt, which has reached 50 per cent of GDP in nearly half of sub-Saharan Africa’s countries. This is a big cloud on the horizon,” she said.

Ms Lagarde called for focus on the youth and asked African countries to take advantage of the continent’s demographic dividend.

“This is a moment where young people can take their destinies into their own hands. In fact, youth in Africa already comprise 75 per cent of the working age population. By 2030, over half of new workers entering the global labour force will come from Africa.

With the right strategy, the demographic dividend can bring prosperity. This incredible surge could translate into a virtuous cycle of economic growth and development,” she said.

Talking about how technology of all kinds needs public involvement and good public-private sector partnerships to succeed, she pointed out that there is a direct link between roads, education and health systems and innovation.

“It is a powerful reminder that technological innovation requires a strong foundation to flourish. This is what I would like to speak about today: The impact of technology for the economies of Africa and the new opportunities being created for the next generation.

Clearly technology does not hold all the answers. In fact, technology often raises new questions, including about the impact of automation. But there is no doubt that technology is an important part of the story,” she said.

She gave a brief overview of the economic context for the application of new technologies and home-grown innovation in Africa, saying, globally, the sun is shining through the clouds and helping most economies generate the strongest growth since the financial crisis. The IMF is projecting 3.6 per cent growth for 2017 and 3.7 per cent for 2018, she said.

“Looking at the continent of Africa, the recovery is strengthening in many countries. Growth is expected to reach 2.9 per cent in 2017 and 3.5 per cent in 2018 and 2019.

This topline number masks significant variations among countries. While nearly one-third of nations are growing at around 5 per cent, others — particularly the commodity exporters — are seeing a slowdown due to lower commodity prices,” she said.

Ms Lagarde asked African leaders to find a way to achieve lasting growth that is stronger and more inclusive, so that people across Africa benefit and see higher living standards.

“Earlier this week, in Benin, I outlined how economic diversification is part of the solution, and how it is critical to strike the right balance between investment and debt sustainability. It is not the only answer. Each country will have to find the right policy mix, and again, harnessing the promise of technology is another way we can accelerate economic and social development,” she said.

She also urged the leaders to consider financial integration, where new technology has expanded access to credit across Africa.

“One of the prime examples is banking. In 2015, nearly 35 per cent of the adult population in sub-Sahara Africa had a mobile money account, the highest percentage in the world.

While Kenya is a leader in mobile banking, other countries are catching up. In Côte d’Ivoire, Somalia, Tanzania, Uganda, and Zimbabwe, and many others. People are now more likely to have a mobile account in these countries than a traditional bank account,” she said.

According to Ms Lagarde, perhaps the greatest obstacle to the development of manufacturing in Africa is the lack of sufficient and reliable electricity.

“Hundreds of millions of people on the continent live without access to power on any given day.

Solar energy is one tool that is making a difference. In the last few years, tens of thousands of people in Ghana and Tanzania have been brought online thanks to new solar businesses. M-kopa, a Kenyan energy company, sells solar panels to rural homes for a small deposit, with the remainder paid off over the course of a year through mobile banking.

“The system has brought electricity to over half a million homes — helping remote areas come online while extending credit to those who need it the most. Energy investment is a focus throughout Africa. In Burkina Faso, in Zambia, in Benin, new solar stations are already in development. In Morocco, construction is underway on a facility that will become one of the largest solar power plants in the world.

“These projects will help Africa close its infrastructure gap, which is estimated to be over $90 billion annually. And they are most likely to succeed when the public and private sector work together.

That is one of the reasons that the IMF is supporting the Compact with Africa, a joint project between the G20 and seven African nations so far, which is designed to boost private sector investment and create jobs,” she said.

Among others she said the IMF is committed to working with all of its members in Africa, as well as its regional and international partners, to help reach these goals. And to help meet the economic goals for the entire continent.

By Emmanuel K. Dogbevi