Single national ID system can facilitate effective credit delivery – Expert

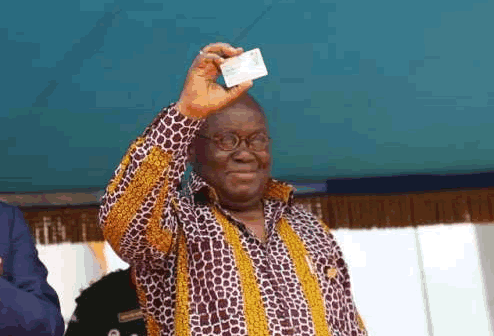

Mr Mawuko Williams, a Senior Micro, Small and Medium Enterprise (MSME) Expert at the Frankfurt School of Business and Management, has called for the adoption of a single national Identification (ID) system to facilitate effective and efficient credit delivery.

Mr Mawuko Williams, a Senior Micro, Small and Medium Enterprise (MSME) Expert at the Frankfurt School of Business and Management, has called for the adoption of a single national Identification (ID) system to facilitate effective and efficient credit delivery.

He said a common national ID arrangement could boost the growth of businesses in Ghana as against the current multiple system that hinders effective credit delivery in the country.

Mr Williams said this during a Financial Literacy and Public Awareness Campaign workshop on Credit Reporting and Collateral Registry for selected Journalists in the Northern, Upper East, Upper West and the Brong Ahafo regions.

He said a multiple borrower with different IDs bearing different names obviously would not help a lender to know the borrower’s total indebtedness upon cross checking with the Credit Reference Bureau.

Mr Williams said SMEs has 80 billion financing gap and if banks could make money available to them, they would expand and more job opportunities would be created to meet the 350 million new jobs required in Africa for the next 20 years.

He said MSMEs were the engines of growth and development responsible for over 50 percent of Gross Domestic Product (GDP) and over 60 percent of employment.

For businesses to contribute more to GDP, then they ought to have access to credit, hence the need for credit infrastructure such as credit bureaus, collateral registry, and identity system as well as insolvency regime to enable a responsible credit system, Mr Williams said

Mr Godfred Cudjoe of the Financial Stability Department of the Bank of Ghana said financial institutions needed information on borrowers to be able to make an informed decision before granting credit facilities.

He said credit reporting fills the gap with the provision of Credit Reports (CR), hence the importance of the Credit Reference Bureau (CRB).

“A time is coming where if you have not obtained a loan before then, you cannot take a loan”, and this means borrowers with good CR would have advantage over non borrowers because they were less risky.

Mr Cudjoe said reputational collateral could help one negotiate for a reduction in interest.

He said when going for loans, creditors should rather look out for the Annual Percentage Rate (APR) before making a decision, hence the need to avoid rushing for loans from one bank.

He urged creditors to cultivate the habit of regularly checking their CR from the three licensed (xdsdata Ghana, Hudson Price and Dun and Bradstreet) CRBs in Ghana to ensure they were no issues with their CR.

Mr Cudjoe said broader and fairer access to credit; better performing loans; prevention of over indebtedness; improved profitability; and stability in the financial sector were some of the benefits of credit referencing.

The overall goal of the campaign is to improve access to affordable credit for the target group including SMEs, Micro Enterprises, farmers, students and the general public.

The Financial Literacy and Public Awareness Campaign on Credit Reporting and Collateral Registry are meant to sensitize journalists to prioritize issues of financial literacy by educating and informing the public to take advantage and improve their financial access.

The training was organized by the Frankfurt School of Finance and Management in collaboration with IFC/World Bank Group.

Source: GNA