Be incorrigibly loyal to your tax obligations – First Deputy Speaker

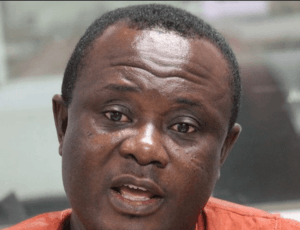

First Deputy Speaker and MP for Bekwai, Mr Joseph Osei-Owusu has emphasised the need for the Ghanaians to be incorrigibly loyal and committed to honouring their tax obligations to accelerate national development.

“When it comes to taxation you should be incorrigibly loyal to your country,” the MP, said.

Mr Osei-Owusu made the call at the opening of a two-day workshop by the Ghana Revenue Authority (GRA) for Parliamentary Press Corps in Ghana held at Miotso-Prampram, near Ashaiman in Greater Accra Region over the weekend.

The workshop was to school the journalists on the new Tax Identification Number (TIN) Policy to enable them communicate more effectively on the new tax legislation.

The TIN Policy, introduced in April 2018, is expected to broaden the country’s revenue to help increase developmental projects in the country.

He said: “It is the duty of every Ghanaian to point out those who are not paying and to ensure that they pay. Paying of taxes is like ‘nnoboa’ (a co-operative system where farmers in rural Ghana rotate to weed work on members’ farms.”

Calling tax evaders “nation wreckers”, Mr Osei-Owusu urged the Media and the Ghanaian society to expose people who do not pay their taxes and make it uncomfortable for them to be present at public commercial places.

He urged the Media to be passionate on taxation issues, and let their loyalty and their bias show in their reportage.

Mr Osei-Owusu said:” You should show pointed bias in favour of every Ghanaian paying his or her taxes. Any Ghanaian who does not get a TIN is a nation wrecker.

According to Mr Osei- Owusu, in some parts of the world, people do not want even to mingle and come close to people who do not honour their tax obligations, and therefore, urged the GRA and the Media to adopt a pulpit approach, and make tax offenders really look like sinners who have lost God’s favour.

The First Deputy Speaker, a former Chief Executive of the Driver and Vehicle Licensing Authority (DVLA), urged the public to embrace the newly introduced Tax Identification Number (TIN) policy and be committed to tax payment.

The policy introduced by the revenue hub will help in the increase of revenue and help the country in its financial growth.

He said: “We should know as a people that taxes are the means by which we build a nation. Talk about unemployment, talk about resources to invest in areas to generate jobs. Talk about infrastructure. We are talking about resources to build the roads we want and therefore it is the responsibility of every Ghanaian to pay his or her tax and point out those who are not paying and ensure that they pay.

“We are talking about resources to build the roads we want; therefore, any Ghanaian who does not get a Tax Identification Number and who does not pay his taxes is a nation wrecker.” he said.

The First Deputy Speaker of Parliament asked the GRA to widen the tax net to include all farmers, explaining that taxation on crops must go beyond those on cocoa to include other crops.

He said the Ghanaian cocoa farmer is charged about 25 to 30 percent in tax for every bag of cocoa and wondered why the plantain farmer or the yam farmer would not pay tax?

Mr Daniel Okyem Aboagye MP for Bantama and a Member of the Finance Committee of Parliament said it was only when all Ghanaians honour their tax obligations that enough revenue would accrue to the government for the nation to realise the Ghana Beyond Aid programme.

Nana Agyemang Birikorang, the Dean of the Parliamentary Press Corps, was appreciative to the GRA for the workshop, and urged other media persons to get well acquainted with the legislation and join in the crusade to make more Ghanaians honour their tax obligations.

Source: GNA