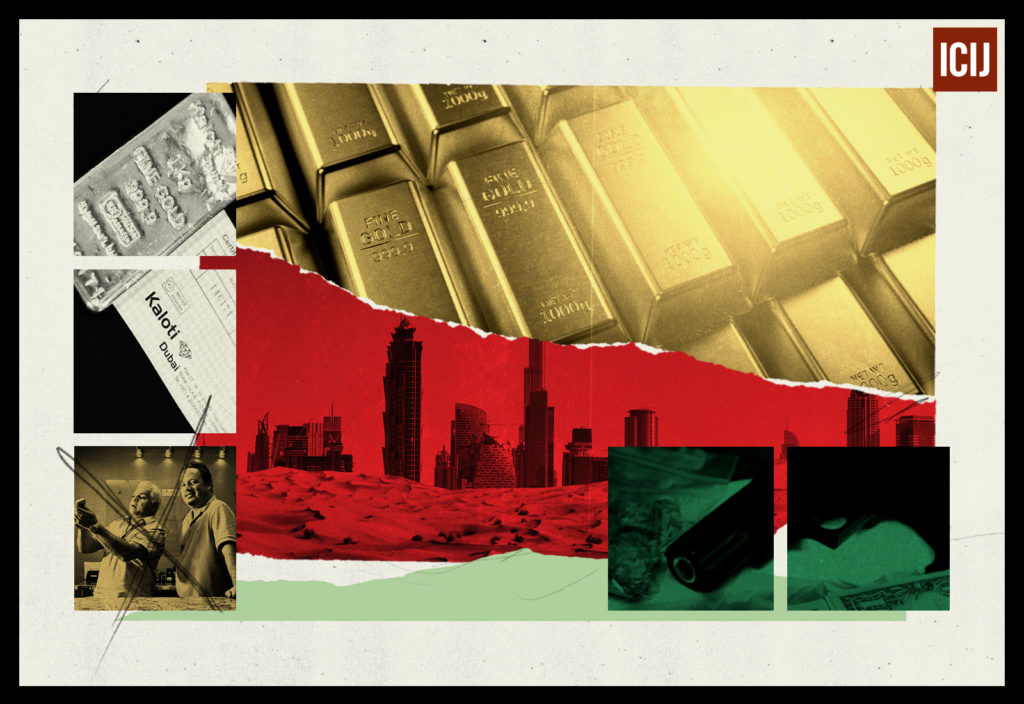

Ghana gold exporters in middle of suspicious $2.8b transactions tied to Kaloti and others

This article has been edited to include a response from the lawyers of Asanska Jewellery Limited and the letter we wrote to them seeking comments.

Ghana might be the largest producer of gold in Africa, but as available information shows, the country very likely is not getting its fair share of money from gold exports. The activities of the Dubai-based gold trader and refiner, Kaloti Jewellery Group was being looked into by US investigators – the investigation was closed without any action. It was discovered during the investigation that some Ghana gold exporters received part of the multi-billion-dollar payments made by Kaloti and other businesses to companies and individuals around the world, according to a new leak of confidential documents from the United States Department of Treasury.

These Ghana exporters, however, have not been cited for wrongdoing.

The five gold exporters in Ghana have been cited in connection with highly suspicious dealings with businesses including Kaloti, and transfers of funds within the gold industry amounting to $2.8 billion.

The records show that bank compliance officers believed that Kaloti has dealt in suspicious transactions in gold over a period of time, and some of these funds were paid to the companies in Ghana.

The information about the Ghana gold companies appears in the FinCEN Files, the new cross-border investigation by Ghana Business News, more than 109 media outlets in more than 88 countries, Buzzfeed and the International Consortium of Investigative Journalists (ICIJ).

The companies are Asanska Jewellery Ltd, Guldrest Resources Company Ltd, Fine Gold Impex Ltd, Gold Diam Export Ltd, and Vital Insight Investments Ltd, an offshore company registered in the British Virgin Islands (BVI) which says it has offices in Accra. Requests for comments and clarification sent to all the five companies, four of them through the Chamber of Bullion Traders, the umbrella association of gold exporters in Ghana, because their offices could not be located in Accra, were not responded to. Only one company, Asanska Jewellery could be located in Accra.

After the original version of this story was published on September 21, 2020, lawyers for Asanska Jewellery wrote to Ghana Business News strongly indicating that their client was not involved in any criminal activity, something not alleged in the original story.

The weaknesses in gold mining and exports regulatory systems in Ghana make it impossible to properly capture the actual revenue the country makes or loses from the gold industry.

“There is no proper enforcement of the licensing regime, lack of political interest to make public, disclosure of mining contracts and contracting processes; from negotiation to signing. Lack of enforcement of small-scale mining regimes and a proper plan to stop illegal mining from the system make it difficult to trace to the point of export.

The biggest challenge is the institutional capacity and willingness to enforce the law without favour,” Nafi Chinery, the Ghana Country Manager of the Natural Resource Governance Institute, told Ghana Business News when asked what she thinks Ghana was not doing right in regulating the gold export industry.

The Dubai-based company had become a key cog in the dirty gold trade, buying the precious metal from sellers suspected of laundering money for drug traffickers and other criminal groups, according to US Drug Enforcement Administration-led task force. Kaloti was found to often pay in cash — sometimes so much it had to be hauled in wheelbarrows — and wired money for suspect clients to other businesses, the investigators believed.

Ghana used to be called the Gold Coast. Its traditional rulers symbolize that endowment even today. Typically, traditional rulers, also known as chiefs or kings are bedecked in generous amounts of gold from head to toe when they appear in public. They wear ornaments made of pure gold; crowns, necklaces, arm bands, wrist bands, rings, some of them representing the level of power within the hierarchy of chiefs or kings.

After independence from the British in 1957, the dreams of Ghanaian citizens that they will begin to benefit from the wealth of the country has yet to materialize. While the country has made some strides in its development efforts, poverty is still pervasive and very few have access to the country’s enormous natural resource wealth including gold.

According to the Ghana Statistical Service, 22.6 per cent of Ghanaians live in poverty and 8.2 per cent live in extreme poverty, and these are households living on less than one dollar a day.

The country has also been impacted by the global pandemic, COVID-19, causing the economy to contract 3.2 per cent. Growth has earlier been revised from 6.8 per cent to 0.9 per cent for 2020.

The country has largely been ruled by corrupt elites in politics and business. While corruption is endemic in the country, there is very little interest in sanctioning corrupt officials. In the Corruption Perceptions Index 2019 released January 23, 2020, by global anti-corruption watchdog, Transparency International, Ghana has dropped seven points since 2014; dropping from 48 in 2014 to 41 in 2019.

State capture by the few has rendered the rest poor, in spite of the fact that the country is the leading exporter of gold in Africa.

While gold is a major export from Ghana, records of gold exports aren’t detailed and sufficient, making it impossible to track and verify specific companies and their export values.

Ghana Business News sent a request to the Minerals Commission seeking information on the five gold companies, but did not receive a response.

The activities of the five gold exporters in Ghana with the Kaloti Jewellery Group and other businesses were flagged as suspicious by banks and the US government was alerted.

The FinCEN Files, is a 16-month-long investigation based on top-secret bank reports filed to the US Treasury Department’s intelligence unit, the Financial Crime Enforcement Network (FinCEN), other documents and dozens of interviews. These sources provide a unique, bird’s-eye view of illicit money flows that supported worldwide corruption and criminality.

The FinCEN Files is based on more than 2,100 so-called suspicious activity reports, or SARs, filed by banks around the world to FinCEN in order to alert the US agency to possible financial crime. The fact that a person or a company is named in a SAR is not evidence of wrongdoing.

The Ghana companies have been doing business with Kaloti Jewellery Group, one of the largest gold traders and refiners in the world, or with companies that did significant business with Kaloti, according to documents seen by Ghana Business News.

According to interviews and the information from the documents available to Ghana Business News and ICIJ, United States investigators after three years of digging, accumulated a large amount of evidence that they believed suggested Kaloti’s possible involvement in money laundering. The investigators believed the evidence sealed the case against a company at the center of Kaloti Jewellery Group, one of the largest gold traders and refiners in the world. But no indictment was filed and the case was closed.

The Dubai-based company had become a key cog in the dirty gold trade, buying the precious metal from sellers suspected of laundering money for drug traffickers and other criminal groups, according to US Drug Enforcement Administration-led task force. Kaloti was found to often pay in cash — sometimes so much it had to be hauled in wheelbarrows — and wired money for suspect clients to other businesses, the investigators believed.

In 2014, the task force investigating the company recommended that the Treasury Department designate Kaloti a money laundering threat under the USA Patriot Act, a seldom-used measure known as the financial “death penalty” because it can freeze a firm out of the international banking system. But the Treasury Department never took action against Kaloti and the US investigation of the company has not been previously reported. A spokesman for the Drug Enforcement Administration (DEA), said the Kaloti case is now closed and declined to answer questions about the investigation.

However, Kaloti denied all the allegations in response to queries from ICIJ. A Kaloti spokesperson, among other things said:

“Kaloti vehemently denies any allegations of misconduct, whether those allegations stem from today or a decade ago. While we have not been provided copies of the reports (including SARs) you reference, the vast majority of your questions ask about activities well over half a decade old, and the asserted DEA and US Treasury reviews of that same information which you appear to concede concluded without any enforcement action. These questioned activities also predate significant regulatory changes in the industry. Kaloti’s business has evolved to comply with those changes and has consistently met or exceeded all applicable regulatory requirements, consistent with industry best practices.”

“Kaloti is a respected, third-generation family business that owns and runs, among other businesses, a long-established precious metals trading company and a state-of-the-art gold refinery in Dubai. It regularly conducts all appropriate and required Know Your Client (KYC) and Anti-Money Laundering (AML) checks, including rigorous interrogation of the World Check database. No regulator, statutory or international body anywhere (including the OECD and UN) – or even any auditor (internal or external), despite annual independent audits – has ever found Kaloti to have conflict minerals, or even the likelihood of such, in any of its supply chains. Nor has Kaloti ever been accused or even questioned by any regulator or legal authority, anywhere, about any material wrongdoing of the kind alleged or any other kind.”

The suspected activity reports reviewed by Ghana Business News and ICIJ describe an amount of $2.8 billion in suspicious payments connected to gold transactions. Of the amount ($124 million) $124,208,560.00 was directly linked to transactions involving companies in Ghana.

The companies are Guldrest Resources Company Limited, which is registered as a gold exporter listed in Ghana; Vital Insight Investments Limited, a company registered in the British Virgin Islands, which does some gold trading and has operations in Ghana, and is a counterpart of Kaloti. Also flagged are transactions with Asanska Jewellery Limited which has an office in Accra and is registered as exporter of gold and diamonds, Gold Diam Export Ltd., and Fine Gold Impex Limited.

Various reports show that between 2008 and 2012, Guldrest Resources Company Limited, Vital Insight Investments Limited, Asanska Jewellery Limited, Gold Diam Export and Fine Gold Impex were listed by banks in suspicious activity reports related to gold.

The FinCEN Files show that from November 9, 2011 to August 28, 2012, Guldrest Resources received 58 transactions totalling $83 million ($83,040,000.00) from Kaloti for trading in gold and purpose of payment was stated as gold trading B/O Gold Diam Export. In another record Guldrest Resources was listed to have received 37 transactions totalling $30.3 million ($30,368,560.00) between November 5, 2012 and April 8, 2013 also from Kaloti for gold trading.

Fine Gold Impex Limited the SAR says received 55 transactions totalling $44.3 million ($44,343,467.00) which occurred from November 5, 2012 to April 10, 2013. Multiple banks were used to pay the funds, the SARs said.

Vital Insight Investments received $550,000 from Kaloti in two transactions between September 28, 2011 and October 6, 2011 and the purpose of payment was gold trading B/O Gold Diam Export.

Asanska Jewellery received 10 transactions within five months from January 23, 2012 to May 14, 2012 amounting to $10.2 million ($10,250,000.00). The funds were sent by JLM Trading FZE, according to the SARs.

In July 2012, for example, Standard Chartered Bank in New York City filed a SAR to report what the bank said were nearly $100 million in “suspicious wire transfers.” Within five months, the bank reported, Asanska Jewellery Ltd received $10.25 million in 10 transactions into accounts at Intercontinental Bank Ghana and Access Bank Ghana from JLM Trading FZE in Dubai. Almost half of the suspicious $100 million was sent by Kaloti to JLM Trading during the same period in 2012, according to Standard Chartered Bank.

In the letter to Ghana Business News by lawyers representing Asanska Jewellery Limited, they wrote among other things:

“You specifically cited our Client as one of five Ghanaian gold exporters involved in highly suspicious dealings within the gold industry” and of ‘receiving funds from a company”, Kaloti, which had allegedly dealt in ‘suspicious gold transactions’, over a period of time.

In addition to making these false allegations, your article categorically portrayed our Client as being engaged in criminal activities including stealing Ghana’s proceeds from gold sales, and money laundering.

Your article further implied that our Client had colluded with a foreign company/companies, the Ghanaian regulatory bodies, politicians in government to avoid prosecution for the said offence.”

We have attached the full contents of the letter to this edited version of our story, as well as Ghana Business News’ letter to Asanska asking for comment.

According to the SAR, Standard Chartered Bank alerted FinCEN to the transactions involving the companies for various reasons, including high-risk jurisdictions, such as the United Arab Emirates, the “high-risk business…in jewelry industry, which is known to be a high-risk industry for money laundering” and because “a number of transactions were remitted in round dollar amounts” which the bank said are “a known vehicle for money laundering.”

Between November 2012 and April 2013, Kaloti sent a total of $44.3 million ($44,343,467) to Fine Gold Impex, and some of the money went into Fine Gold’s account in Beirut, Lebanon, held with FRANSABANK SAL.

In May 2012, Standard Chartered Bank submitted a report to FinCEN about possible suspicious transactions worth $3.9 million. The report related to 11 companies, including Vital Insight Investments Ltd. According to the bank, the company is registered in the tax haven of British Virgin Islands but has an “operations office” in Accra. The bank said the company’s owner was Indian citizen Dilip Parsram Wadhwani.

Vital Insight Investments “appears to be a potential shell company with no verifiable business purpose,” the bank wrote.

According to the bank, on September 28, 2011 and October 6, 2011 Kaloti sent Vital Insight Investments $550,000. The purpose of the transaction was said to be “Purpose of Payment: Gold Trading B/O Gold Diam Export Ltd.”

According to the Ghana Investment Promotion Centre, Gold Diam Export Ltd is a company with offices in Ridge, Ghana, that exports precious metals.

In various ways, the Ghana transactions were all connected to Kaloti and banks’ concerns about the Dubai-based gold refiner.

The transactions took place when Kaloti Jewellery Group was one of the targets of a money laundering investigation carried out by a task force led by the US Drug Enforcement Administration. As part of the FinCEN Files, ICIJ has revealed previously undisclosed details about this money laundering probe and its connection to West Africa gold traders. The US investigation occurred between 2011 and 2014. Specifically, US investigators suspected that a company in Benin, Trading Track Company, and other companies doing business with Kaloti Jewellery Group were involved in laundering drug money through gold.

US investigators did not investigate the Ghana gold companies and there is no suggestion that the companies were involved in financial crimes. However, the timing of the transfers during the US-led investigation and Kaloti’s well-publicized controversies raise questions about the Ghana companies’ dealings with the Dubai-based gold refinery.

“Even though illegal mining was banned in Ghana between 2017 and 2018, gold sales for that period exceeded that of the year before the ban,” Gideon Peasah, a natural resource governance expert told Ghana Business News.

Even though Kaloti continues to do business today, its refinery business has lost its accreditation to the “Dubai Good Delivery (DGD)” list in 2015 – which is effectively a requirement for trading in the mainstream, international bullion markets. That, however, has not stopped Kaloti from being a significant player in Dubai. Meanwhile, the family behind the business has since set up another refinery.

Until its removal from the DGD list in 2015, Kaloti was the largest refinery in Dubai.

The Files however, show that several banks quietly decided to drop Kaloti as a client shortly after rumours of a Department of Justice (DoJ) investigation emerged. Concerns about the firm became more public in February 2014 when Kaloti was the subject of a whistleblower data leak 3, showing it appeared to have traded with suspect gold suppliers, buying smuggled gold, criminal gold and conflict gold. In 2012, Kaloti paid $5.2 billion in cash-for-gold, compared to $6.6 billion of transactions through the conventional banking system. Cash-for-gold transactions are often designed to avoid the banking system.

Gold has been mined in Ghana for over 100 years, and in the last three years, Ghana overtook South Africa as the leading producer of gold in Africa. But Ghana doesn’t seem to get all the value of its gold exported out of the country.

In April 2017, the then Ghana Minister of Lands and Natural Resources, John Peter Amewu estimated that $2.3 billion worth of illegally-mined gold left Ghana in 2016, while the country earned $3.2 billion from official gold exports in 2015.

“Even though illegal mining was banned in Ghana between 2017 and 2018, gold sales for that period exceeded that of the year before the ban,” Gideon Peasah, a natural resource governance expert told Ghana Business News.

Available data shows that total gold output in Ghana rose from 3.8 million ounces in 2016 to 4.9 million ounces in 2018.

Asked why the gold export business in Ghana is opaque, Ms Chinery said the informal nature of the small-scale sector has caused a lack of monitoring of production and trade.

“The institutions responsible for monitoring and formalizing the sector are beneficiaries coupled with the high political interests and interference in the sector. It seems as if there is a deliberate political interest to keep the mining institutional structure weak and opaque for the varied different interests to benefit,” she added.

Meanwhile, the mining city of Obuasi in the Ashanti Region of Ghana is a typical example of how little gold mining has benefitted the citizens under whose feet the precious mineral is being mined.

Richard Ellimah, the Executive Director of the research and advocacy organization in the extractive sector, Centre for Social Impact Studies (CeSIS) has this to say about the city; “Obuasi has been mining gold since 1897. Sadly, there is very little to show for the enormous gold resources that have left the city, to build first class infrastructure in other parts of the country, while Obuasi’s infrastructure continues to deteriorate.

I have heard people ask the question: ‘Why is Obuasi not like Johannesburg or Perth?’ The answer is simple: very little of the mineral wealth is returned to the city. So we practically sit on gold but remain poor. I can liken it to what Bob Marley said: sitting by the river and washing your hands with spittle!”

Asanska Jewellery Limited, has however still failed to address our full enquiries sent to them before our story was published, which will be added to the story if and when they are received.

By Emmanuel K. Dogbevi