Pandora Papers: The Israelis making millions in Ghana from government contracts

Ghana is eager to develop – building infrastructure and making its economy strong. The country therefore has a generous tax holiday regime, and a procurement law that allows for multi-million-dollar infrastructure deals to be sole or single sourced without competitive bidding. It is no wonder then that private foreign companies troop into the country for a bite of the single source pie.

Ghana is eager to develop – building infrastructure and making its economy strong. The country therefore has a generous tax holiday regime, and a procurement law that allows for multi-million-dollar infrastructure deals to be sole or single sourced without competitive bidding. It is no wonder then that private foreign companies troop into the country for a bite of the single source pie.

With governments permitting and using these provisions in the procurement laws, many companies don’t have to go through competitive bidding to obtain money-spinning government contracts, making it possible for governments and their agencies to hand lucrative multi-million-dollar contracts to favourites.

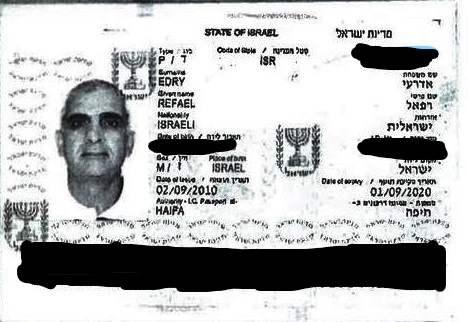

One such company is Amandi Holdings, and its beneficial owners are Israelis including three brothers whose names appear in the Pandora Papers. They are Refael Edry, who controls some of the companies in the group, or companies associated with it, and his two younger brothers – Eyal Nissim Adrei (63) and Moshe Edree (54) who is also a British citizen.

Governments and agencies have over a long period of time handed a number of contracts to them. Amandi Holdings, which is operating in Ghana in different sectors such as IT, construction and energy is an offshore company registered in the British Virgin Islands (BVI), the Pandora Papers show. Amandi has obtained contracts relating to elections, construction of railway lines, real estate, airports and energy. The leaked documents give a peek into how Amandi, which also gets generous tax exemptions from contracts in Ghana, makes handsome profits and pays dividends to the senior Edry.

However, the company is so well masked that the Ghanaian authorities believe it’s an Israeli company, and the brothers are not known in Ghana. In a report by the Finance Committee of Parliament on one major energy contract that Amandi was given, the then Minister of Energy for Ghana told the Committee that Amandi Energy Ghana is a joint venture company owned by Amandi Group of Companies and Superlock Technology Limited (STL) of Israel. But the leaked Pandora Papers show that the Amandi Group and STL are all registered as offshore companies and our investigation has established that they are not registered in Israel.

The Pandora Papers investigation is the world’s largest-ever journalistic collaboration, involving more than 600 journalists from 150 media outlets in 117 countries, including Ghana Business News.

Coordinated by the International Consortium of Investigative Journalists (ICIJ), the investigation is based on a leak of confidential records of 14 offshore service providers that give professional services to wealthy individuals and corporations seeking to incorporate shell companies, trusts, foundations and other entities in low- or no-tax jurisdictions. The entities enable owners to conceal their identities from the public and sometimes from regulators. Often, the providers help them open bank accounts in countries with light financial regulation.The 2.94 terabytes of data, leaked to ICIJ and shared with media partners around the world, arrived in various formats: as documents, images, emails, spreadsheets, and more.

The Pandora Papers investigation is the world’s largest-ever journalistic collaboration, involving more than 600 journalists from 150 media outlets in 117 countries, including Ghana Business News.

The investigation reveals the secret assets, covert deals and hidden fortunes of the super-rich – among them more than 130 billionaires – and the powerful, including more than 30 world leaders and public officials. The confidential documents also feature a global cast of fugitives, convicts, celebrities, football stars and others, including judges, tax officials, spy chiefs and mayors.

The Directors of Amandi Holdings are listed as Yaron Tal, Rony Edry, Tomer Edry, Moshe Edree, and Yeheskel Makmal. Their appearance in Pandora Papers does not suggest any wrongdoing. In another public project document summarizing a loan agreement for the major energy contract in Ghana with the Overseas Private Investment Corporation (OPIC), a United States government investment agency for an amount of $250 million, the following are listed as foreign sponsors: Aldwych International Limited (U.K.) Eyal Edry (an Israeli citizen) Moshe Edree (an Israeli citizen) Yaron Tal (an Israeli citizen) Yeheskel Makmal (an Israeli citizen) and Lenda Trust (Mauritius).

The Beneficial Owner

In the leaked documents however, the name of the senior Refael Edry, appears as the Beneficial Owner of most companies including Amandi Holdings, but his name doesn’t appear in the public document of project summary of the Amandi Energy project in Ghana.

Pandora Papers reveal that the person behind STL is an Israeli named Refael (Rafi) Edry (65). In a document from Alcogal, a company which provides services to offshore companies, he is listed as living in London. Edry owns STL through another company registered in the British Virgin Islands called Darden Technologies. Over the years, secondary shareholders in the parent company, Darden, have changed, but Edry continued to be the main shareholder, and in a document dated November 2018 he is mentioned as the sole shareholder.

Pandora Papers reveal that the person behind STL is an Israeli named Refael (Rafi) Edry (65). In a document from Alcogal, a company which provides services to offshore companies, he is listed as living in London. Edry owns STL through another company registered in the British Virgin Islands called Darden Technologies. Over the years, secondary shareholders in the parent company, Darden, have changed, but Edry continued to be the main shareholder, and in a document dated November 2018 he is mentioned as the sole shareholder.

Along with STL, Edry’s parent company also controlled a company named “Amandi Holding” as it appears in the leaked documents.

Meanwhile, the documents show that Amandi Holdings and STL are subsidiaries of the holding company, Darden Technologies (which is held by Refael Edry).

The exact role of the IT company STL in Ghana’s 2012 elections became a subject of dispute, with the election results eventually being settled in court. While the then opposition party, now the ruling New Patriotic Party (NPP) disputed the election results and, claimed STL was involved in transmitting the results, the Electoral Commission of Ghana said it contracted STL to only manage its biometric verification systems.

Amandi Holdings wins multiple projects in Ghana through single sourcing

Amandi Holdings has won multiple projects in Ghana, mostly single sourced, records of the Public Procurement Authority (PPA) show.

Under Ghana law, justification can be sought under Clause 40 of the Public Procurement Act (Act 663) to single source projects, but institutions are required to demonstrate that their proposed application for single source can be justified under provisions outlined in the law.

The PPA has listed majority of the following deals that Amandi Holdings has been awarded as single source contracts by governments and agencies of government, but without enough clarity. The list does little to extend any transparency that the PPA seeks to portray as reasons for approving single sourced contracts, some approved within 24 hours are not provided. The company is constructing railway lines; sea defence projects; remodelling works for Ghana’s National Health Insurance Secretariat; contract to work on redistribution lines for the Bulk Oil Storage and Transportation Ltd (BOST); a deal from the Ghana Grid Company to finance and construct the 330kv Aboadze-Prestea Transmission Line.

Amandi had a contract from the Ministry of Water Resources, Works and Housing to construct 368 housing units; it was given a contract through single sourcing to build the headquarters annex of the National Health Insurance Secretariat; and from the Volta River Authority it won a deal to build a commercial building in Accra.

It also has a deal, to build a new headquarters for the Ghana Civil Aviation Authority, also on single source. Amandi built the Ho Airport as well.

Patrick Stephenson, the Senior Programmes Officer, International Budget Partnership (Ghana) says, “the public or government institutions in question that have awarded contracts to Amandi and its closely related entities, are by law procurement entities, and do have the capacity and backing of the law to contract with Amandi. Also, Act 663, and its amendment Act 914 must be read and applied in such a way that, their provisions around sole sourcing don’t appear to be applicable after the facts of the selected cases involving Amandi.

But even if anyone decides to advance the argument that these two laws which are preceded by the Amandi transactions cannot be applied in assessing the validity or otherwise of the solely sourced Amandi contracts, simply because the laws are enacted after these transactions, the point is that, provisions regarding sole sourcing the 2003 version of the public procurement law on single sourcing have been maintained through time in the revised 663 and its amendment 914, so the argument may not hold.”

He argues that the facts as stated by the PPA, provide little context for understanding the rationale for the use of single sourcing from the government under the current and previous framing of the conditions for single sourcing under the procurement processes.

“Section 40 subsection (1) and clauses (a)-(f) detail the conditions under which the single sourcing approach can be used. None of the conditions provided seem to be present to necessitate the use of single sourcing as a mechanism for procurement by any of the entities,” he adds.

He says further that a weak interpretation of clause (d) bordering on suitability of a prior supplier for the purposes of standardization, size, reasonability and unsuitability of substitutes could result in this, but it is still not clear from the general description of construction works that this transaction or works qualify.

“Crucially, no part of the core work of the entities could potentially border on security to trigger the use of single sourcing, besides the NHIS sensitive infrastructure, but even then, the use of sensitive infrastructure and security, cannot be used as a cover for the use of single sourcing,” he argues.

“Section 40 subsection (1) and clauses (a)-(f) detail the conditions under which the single sourcing approach can be used. None of the conditions provided seem to be present to necessitate the use of single sourcing as a mechanism for procurement by any of the entities,” he adds.

Ghana Business News and Israeli news outlet Shomrim are further collaborating on this story. We have sent an enquiry to the PPA seeking clarifications, but it hasn’t responded as at the time of publishing this story. The PPA has however, informed Amandi Holdings that journalists are looking into its contracts.

In response to questions about why government institutions are giving it single source contracts, the CEO of Amandi Holdings, Nadav Simhoni, had this to say; “It is not all contracts in Ghana that are won on single source. PPA is the authorizing authority for the method of procurement. They are the single authority to approve sole source procurement.

As such, any transaction that was authorized the usage of sole source procurement method must be published. It is not implying that any approved procurement eventually becomes a contract, due to many reasons. Other procurement methods are being approved by the Tender Authority and all of these methods are within the confines of the Procurement Act.”

“We are a business operating in Ghana, and like every other business it is there to make profit for shareholders. We are happy that we have the ability to introduce advanced technology and knowhow in Ghana,” he added.

Amandi Energy tax exemptions

In preparing the Aboadze energy project in Ghana for instance, the Ministry of Finance in February 2016 sent a Memorandum to Parliament requesting tax exemptions for Amandi Energy Ghana, one of the companies in the group. Amandi was incorporated in Ghana on July 11, 2012 as a Special Project Company to develop the power plant and was awarded a provisional Power Generation Licence by the Energy Commission of Ghana on October 9, 2012. According to other documents seen and reviewed including documents submitted to the Parliament of Ghana, the project value was estimated at $409,120,000 and $528,820,000.

The Ministry requested tax exemptions to the tune of $83.2 million for the $409 million energy project. The breakdown is as follows: Import duties and taxes (offshore) $24,539,261; Domestic VAT/NHIL/WHT (Onshore) $29,839,261; Withholding taxes (Other EPC) $20,000,000 and Stamp duty assessment, $8,841,350.

One of the justifications the Ministry of Finance gave for the tax exemptions was this: “The project is expected to generate revenue and pay corporate tax in excess of $4 billion, through its life-time of 25 years and also pay other income taxes which will complement government’s income generation effort.”

Amandi and the Electricity Company of Ghana executed a Power Purchase Agreement under which Amandi agreed to supply to ECG 190-240MW of power over a 25-year period. Amandi has so far completed a 192MW combined cycle power plant yet to be commissioned.

The World Bank and the US government are co-financiers of this power project. In 2013 when this power agreement was signed Ghana was facing an energy crisis. The crisis led to power outages that became known as ‘Dumsor’. The country’s total peak at that time was 1,943MW, and the government argued that with a forecast peak demand of 2200MW in 2014 by 2015 electricity demand would outstrip available installed generation capacity at that time, which was 2,850MW. The government therefore set a target to generate 5000MW of power. This among other reasons were the justification for the Amandi deal to be given on single source.

“We have invested in the power plant. We didn’t build it. Rather GE built the power plant. At the time Ghana had a power crisis, we took the risk to invest. Amandi has the capacity, networks and worldwide connections to bring such a huge investment into Ghana and help reduce the effect of the Dumsor,” Simhoni said.

He added; “Amandi initiated, arranged the financing for the power plant while it was built by GE. Amandi, did local facilitation for investments, financing, framework of the structure, worked on Parliamentary tax exemption together with the Ghana Investment Promotion Centre (GIPC) and based on approved laws and regulations.

There were several other investors initiating independent power production plants at the same time due to the power crises, all going through the same process,” he said.

When asked what the tax exemptions meant to Amandi, he said, “it is not what it meant to Amandi, but rather what it meant to the country. Tax exemption was granted based on laid down laws and regulations and were supported by GIPC, Parliament and Ministry of Finance. If we didn’t get the tax exemptions, the taxes would have been added to the cost of the power plant and eventually would have been built into the price consumers pay for the power.”

In June 2020, the Ghana government announced another Amandi contract. This time the project was reputed to be the biggest railway contract in the history of Ghana – a $560 million deal for a railway project for the construction of sections of the Western Railway Line (Standard Gauge Line) between Takoradi Harbour and the Huni Valley, consisting of 102km of continuous single track railway line, with stations along the track.

Simhoni however says Amandi won the railway contract in a competitive bid.

“We have actually won following a tender process that did not conclude as originally planned since the government of the day could not raise the funds or the prioritization to enable the project take off at that time. We submitted our bid in 2010 and we were the most responsive company. There was no much funds available at the time, and since we were the most responsive bidder we in 2012 were given a small section – 15km. Based on our performance in that contract and the fact that we delivered, we were given more contracts to continue the construction of the Western Line, following due procurement processes. We have been working with the Ghana Railways in construction since 2009. I believe that we’ve been doing a good job as a contractor, delivering and meeting requirements. That may be the reason we keep getting contracts. I’m proud of what we do, I believe that if one is doing a good job, you keep him.”

Ghana’s growing debt burden

Even though the country has chronically struggled to generate revenue, it continues to pile up debt. The country’s public debt according to the Bank of Ghana, has increased to 76.4 per cent of GDP, amounting to GH¢335.9 billion, about $56 billion at the end of July 2021, compared with 76.0 percent of GDP (GH¢291.6 billion, approximately $48.6 billion) at the end of December 2020. Of the total debt stock, domestic debt was GH¢173.4 billion or $28.9 billion (39.5 percent of GDP) while the external debt was GH¢162.5 billion $27 billion (37.0 percent of GDP).

The tax exemptions regime

Ghana however, continues to give generous tax exemptions to private companies to attract investments.

But, Dr Theophilus Acheampong, an Economist and Risk Analyst, says the country’s tax exemption regime is open to abuse. He believes that the passage of the Tax Exemptions Bill is therefore, critical to streamlining the uncoordinated tax exemptions regime and preventing age-old abuse of the system.

“These tax waivers are given to local and foreign companies as a means to encourage investment and foreign direct investment into the country – include things like VAT, customs and import duty exemptions. However, these are often abused including by not-for-profit organisations who clear goods under the auspices of being charitable organisations but end up selling these for-profit – i.e., commercial ventures,” he said.

Dr Acheampong noted further that some of the other sectors that have been cited in various reports for abuse include telecoms, mining, energy and manufacturing.

“Ministry of Finance data indicates that Ghana lost GH¢5 billion ($862 million or 1.3 per cent of GDP) in 2019 through exemptions, up from GH¢392 million in 2010.

I strongly urge the House to pass this bill which has been pending before parliament since early 2019. The new law will augment the government’s domestic tax revenue mobilisation drive,” he added.

Dr Acheampong also recommends that “some of the claims can be made ex-post where companies must present qualifying paperwork that shows the actual taxes they actually paid in order to be granted the exemptions. The ex-ante approach leaves too much room for abuse,” he said.

The country’s tax revenue to GDP was 11.5 per cent in 2020 and is estimated to reach 13.24 per cent in 2024. Meanwhile, the average tax revenue to GDP for middle-income countries is over 25 per cent. Ghana’s total revenue to GDP was also 14.3 per cent in 2020 and is expected to rise to 16.9 per cent in 2024. With an average total revenue to GDP for middle income countries being about 30 per cent.

A Ghanaian tax expert who asked not to be named, told Ghana Business News that if the purpose of a tax exemption is to attract certain investments into the country, it is difficult to make an assumption based on a cost-benefit analysis to determine whether the country is gaining or losing from it.

“This is because in some cases, the projects may not happen if exemptions are not granted to make it attractive enough for investors to come in. However, when these projects or entities establish, they create jobs for the people, the employees pay income taxes, the companies pay corporate taxes, and also collect indirect taxes for government in some cases. All that will not be existent if the exemptions are not granted to attract them to the country bearing in mind granting tax exemptions is not necessarily handing out cash,” the expert said.

The expert who also agreed that tax exemptions are a good way to attract investments in infrastructure says, though most projects would be bankable without tax exemptions, the argument has always been that some projects won’t achieve the required Internal Rate of Return if tax exemptions are not granted.

“And, lenders are generally reluctant to loan funds to pay for taxes,” the expert added.

But Sorley McCaughey, Christian Aid Ireland’s Head of Policy and Advocacy has a different view.

He says the evidence does not always support the claim that tax incentives are what attract a company to a particular country.

“More important are political stability, rule of law and so on. Tax incentives can have the effect of depriving governments of much needed revenue,” he said.

McCaughey argues further that tax incentives are often granted without full governmental oversight and transparency- one government department may grant an incentive to one sector without other parts of government knowing. This can lead to damaging policy incoherence.

“It is often not clear as to what the cost benefit analysis underpinning the incentive is. It is also the case that often tax incentives are allowed to continue without periodic analysis of whether they are achieving their objectives.

Tax incentives (which are usually granted to foreign multinationals) often disadvantage smaller domestic industries and squeeze them out. That’s not to say that well targeted tax incentives can’t be positive- but they need to incorporate transparency, appropriateness, time bound etc.” he added.

Darden pays Edry dividends of $55 million

Documents obtained from the leaks show that the companies are indeed making profits. From April 2017 to January 2018, Darden Technologies paid Edry dividends of $55 million.

“The value of the Company’s assets exceeds its liabilities and immediately after the distribution of dividends, the Company will be able to pay its debts as they fall due in the ordinary course of its business,” the document states.

A spokesman for the brothers wrote these in response to questions, without pointing to the specific facts or data contained in the letter of enquiry; “The facts and data presented in the article are full of errors and inaccuracies and are untruthful. In general, as a private company, we do not refer to our business activities publicly, but we would like to state that they are all conducted legally and in a transparent manner with all of our partners – in Africa and in Europe. For decades of extensive business activity, our work has been flawless. This has been and will be the case.”

From these dividend amounts paid, it is not clear what rate of profit the Amandi entities who have benefitted from single source contracts are able to command. Logically, when bids are competitively evaluated, there is an incentive for bidders to moderate their fees, prices and ultimately profits. Single-source quotations deprive the Ghana state of this important cost-saving feature.

In most other jurisdictions, single source work seems to be awarded as a rare exception. When it does happen, the reasons for deviating from procurement best practices are publicly disclosed. Unfortunately, the reasons for Amandi’s sole-source successes are as opaque as an off-shore bank-account in a tax haven, somewhere.

By Emmanuel K. Dogbevi

Copyright ©2021 by NewsBridge Africa

All rights reserved. This article or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.

A mind-boggling research piece.

Nothing criminal or illegal here. For a country that is barely able to raise capital for any type of investment after allocating its lean resources to the mandatory funds and debt repayments, tax holidays and incentives are the next best ways of meeting infrastructural needs. Much awrite about nothing.

An embarrassing piece of gossip masked as journalism.

Rather than mobilise the technical capacity of the public sector into a robust, agile and results-oriented task-force institutions, to outcompete in the international financial markets, here again an incompetent african government is licking the boos of shadowy criminal foreigners who are task haven crooks. These characters cannot ply similarly in ISRAEL, so they hedge in TAX HAVENS, to swindle Ghana’s weak legislative administration, in cahoots with corrupt self-hating Ghanaians, who’d rather deal with FOREIGN CRIMINALS than NATIONALISTIC GHANAIAN MILIONAIRES who could even do a better job. Will the AISRAELI GOVERNMENT contract infrastructure to AFRICAN BILLIONAIRES, NO MATTER HOW TECHNICALLY-EQUIPPED THEY ARE?

I am an European and not racist at all; but what I know of African Leaders, licking the boots of Foreign Crooks disgusts me. I any event, these crooks are nowhere near the best in the World and there is no reason for them to be granted such MONOPOLY!

With the kind of Politicians Africa has today, sadly Africa is fastly sinking ship. There are very smart, technically-competent, pious, Africans, including some I studied with. Shockingly, the African Electorate would rather vote for crooked Politicians who DECEIVE them, than the technocrats who have Africa at heart.

While hardly any non-African will support the dodgy dealings revealed by the Pandora, you’d be surprised that some Africans, Ghanaians would be pitching for these Israeli Crooks and Crooked Politicians. Any wonder there is still Racism in the World??? When corrupt African Politicians and public servants display so much lack of LATERAL THINKING, PROBLEM SOLVING ABILITIES, NATIONALISM & VISION to get Ghana/Africa out of the rot – rather choosing to lick the boots of any NON-AFRICAN with DIRTY MONEY, NO MATTER THEIR CRIMINAL OR SHADOWY PAST, to enslave their PEOPLES under INFRASTRUCTURAL BURDEN!!!

WHAT HAS GHANA AND AFRICA NOT GOT TO BECOME SELF-RELIANT, WITH SMART, COMPETENT, GOVERNANCE & VIBRANT YOUTH IN TOE?

It’s quite frustrating, looking at the income levels of Ghanaians, revenue generation,, and the size of taxes that are lost through exemptions. While our governments promises heaven and earth during elections, they turn around with these multinationals to milk the poor. The poor remain poorer and can never rise.