Cash-strapped GIPC spends over GH¢50m on foreign travels in six years

The Ghana Investment Promotion Centre (GIPC), faced with cashflow issues has come under intense scrutiny for its exorbitant spending on foreign travels.

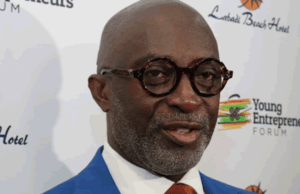

Under the leadership of the over-aged CEO, Reginald Yoofi Grant, the organization has reportedly burned through over GH¢50 million on international trips between 2017 and 2023, raising serious questions about financial prudence and accountability.

The figures obtained from the GIPC through painstaking investigation, paint a picture of escalating expenditure that has left economists and GIPC staff alike reeling. From a relatively modest GH¢2.5 million in 2017, foreign travel costs skyrocketed to GH¢17.2 million in 2022, before slightly receding to GH¢13.7 million in 2023. Even accounting for the pandemic-induced lull in 2020, the overall trend shows an upward trajectory that seems at odds with the Centre’s mandate to promote investment in Ghana.

But it’s not just the foreign jaunts that have raised eyebrows. An additional GH¢6 million has been funneled into local travels, with whispers of favoritism as a select group of the CEO’s associates reportedly enjoy the lion’s share of these domestic excursions.

The 65-year-old Grant, far from being chastened by the mounting criticisms, has allegedly resorted to pre-financing some of his official travels. This peculiar arrangement, ostensibly necessitated by cashflow difficulties, has only added fuel to the fire of discontent smoldering within the GIPC’s ranks.

“The CEO has had to partly prefinance his official travels in some instances and support other staff when there are cashflow issues due to delay in payments from fees on TTAs.” Note: the expenditures are recorded based on nature and not officer involved, was a response from Jonas Danquah, Right to Information Officer at the GIPC, when we sought to find if there were instances that the CEO had to use his own funds to embark on foreign travels.

“Our boss continues to engage in luxurious foreign travels whilst our salaries can’t be paid regularly,” lamented one staff member, speaking on condition of anonymity. The frustration is palpable, with reports emerging of significant delays in salary payments. In a particularly galling instance, February 2024 salaries were only disbursed in early April, after the Centre secured a GH¢3 million loan from the Ministry of Finance.

The controversy has sparked a broader debate about the efficacy of GIPC’s current operational model. An economist, speaking off the record, suggested that establishing foreign offices staffed with skilled personnel would be a more cost-effective approach to driving investment. “Such a strategy would obviate the need for frequent travels by the CEO and other officials,” the economist argued, hinting at potential ulterior motives behind the current travel-heavy approach.

As the story unfolds, questions arise. Why has the GIPC board allowed such profligate spending to continue unchecked? What tangible benefits have accrued to Ghana as a result of these extensive travels? And perhaps most pressingly, how can an organization tasked with attracting foreign investment justify such lavish expenditure when it struggles to meet its basic financial obligations?

With multinational companies reportedly exiting Ghana due to an unfriendly business environment, the GIPC’s role in promoting the country as an investment destination has never been more critical. Yet, as this scandal lays bare, the very institution charged with this vital mission appears to be mired in a quagmire of its own making.

As calls for accountability grow louder, all eyes are now on the government and regulatory bodies to take decisive action. The future of Ghana’s investment landscape may well hinge on how this controversy is resolved, making it a story that will undoubtedly continue to captivate the nation in the months to come.

By Innocent Samuel Appiah