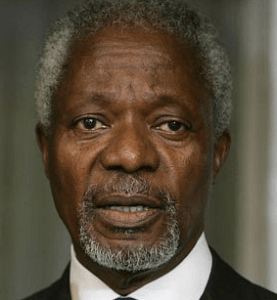

Tax avoidance, evasion have direct impact on mothers and children in Africa – Kofi Annan

Former UN Secretary-General, Kofi Annan has reiterated the negative impacts of tax avoidance and evasion on the world, indicating that these activities while they are global issues, “have direct impact on the lives of mothers and children.”

Mr. Annan made the comments in a statement following the release of the 2013 Africa Progress Report today Friday May 10, 2013, which says Africa is standing on the edge of enormous opportunity, pointing out the fact that African policy makers have critical choices to make.

“They can either invest their natural resource revenue in people to generate jobs and opportunities for millions in present and future generations. Or they can squander this opportunity, allowing jobless growth and inequality to take root,” the report suggested.

The Report prepared by the ten-member Africa Progress Panel chaired by Kofi Annan, finds that in many African countries, natural resource revenues are widening the gap between rich and poor, adding that “although much has been achieved, a decade of highly impressive growth has not brought comparable improvements in health, education and nutrition.”

The Africa Progress Panel also says it is convinced that Africa can better manage its vast natural resource wealth to improve the lives of the region’s people by setting out bold national agendas for strengthening transparency and accountability.

According to the report, despite Africa’s huge resources, international tax avoidance and evasion, corruption, and weak governance represent major challenges.

The report welcoming the commitment from the current G8 presidency, the United Kingdom, and other governments to put tax and transparency at the heart of this year’s dialogue, also urges all OECD countries to recognize the cost of inaction in this vital area.

“Africa loses twice as much in illicit financial outflows as it receives in international aid,” the Panel noted.

A release on the report indicates that it details five deals between 2010 and 2012, which cost the Democratic Republic of the Congo over $1.3 billion in revenues through the undervaluation of assets and sale to foreign investors.

“This sum,” it says, “represents twice the annual health and education budgets of a country with one of the worst child mortality rates in the world and seven million pupils out of school.”

By Emmanuel K. Dogbevi