GRA, Vodafone Ghana tax dispute: Commissioner-General refuses waiver of 30% payment

In a dramatic turn of events in the Ghana Revenue Authority (GRA) and Vodafone Ghana tax dispute before court, the Acting Commissioner-General of the GRA has refused to grant a waiver of the payment of 30 per cent of the value of tax in contention.

In a dramatic turn of events in the Ghana Revenue Authority (GRA) and Vodafone Ghana tax dispute before court, the Acting Commissioner-General of the GRA has refused to grant a waiver of the payment of 30 per cent of the value of tax in contention.

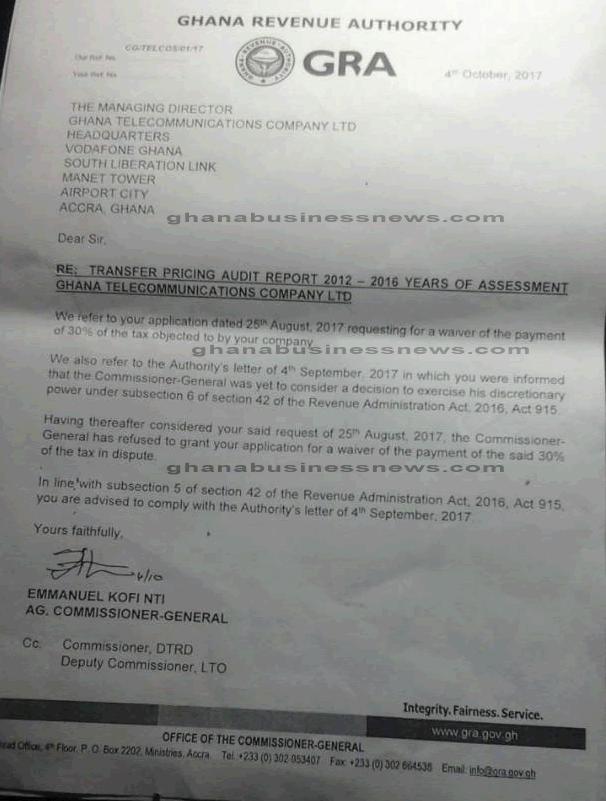

In a letter to Vodafone dated October 4, 2017, obtained by ghanabusinessnews.com, the Acting Commissioner-General of the GRA, Mr. Emmanuel Kofi Nti, says he will not grant the waiver requested by Vodafone. The Commissioner-General has discretionary powers to grant waivers in tax disputes.

In July 2017, the Transfer Pricing Unit of the GRA conducted a Transfer Pricing audit of the company for the 2012 – 2016 years of assessment and found Vodafone liable of GH¢162,468,361.90 in taxes. But Vodafone disagreed with the GRA’s use of the Technology Transfer Regulations, 1992 (L.I. 1547) instead of the Transfer Pricing Regulations, 2012 (L.I. 2188,) in the audit exercise, court documents show.

In a back and forth correspondence between the two, the GRA counteracts Vodafone’s assertions by arguing that after subjecting the company’s transactions to the Technology Transfer Regulation 1992, (L.I. 1547), it established that the transactions do not meet the Arm’s Length Test.

Following several meetings to resolve the matter, the GRA asked Vodafone to submit its grievances in writing. That was done through its consultants, KPMG, the document states.

However, Vodafone while waiting for a response from the GRA, it instead received an audit report with the tax assessment of GH¢162,468,361.90 from the Transfer Pricing Unit of the GRA, which demanded that the stated assessment should be paid within 14 days. Vodafone however, objected to the demand.

The telecoms provider then went to court asking the court to compel the Commissioner-General to determine its request for a waiver of the said payment of the 30 per cent of the amount which is to the tune of GH¢49 million.

Meanwhile, in response to Vodafone Ghana’s objections, the GRA has said among others in an Affidavit to the court that between 2012 and 2016, Vodafone Ghana has remitted GH¢2.1 billion to its parent company outside Ghana. The amount, the tax authorities say is about 30 per cent of the telecoms provider’s turnover, adding that the company has not paid corporate income tax for six years. A fact that Vodafone officials have admitted arguing that it is because the company hasn’t made any profit since it took over Ghana Telecoms in 2009.

The matter has been adjourned twice already. The Court will however hear the case today after Vodafone Ghana prayed the court to adjourn to today October 23, 2017.

Below are the full details of the letter:

“We refer to your application dated 25th August 2017, requesting for a waiver of the 30% of the tax objected to by your company.

We also refer to the Authority’s letter of September 4th 2017, in which you were informed that the Commissioner-General was yet to consider a decision to exercise his discretionary power under subsection 6 of section 42 of the Ghana Revenue Management Act 2016 Act 915.

Having thereafter considered your said request of 25th August, 2017, the Commissioner-General has refused to grant your application for a waiver of the payment of the said 30% of the tax in dispute.

In line with subsection 5 of section 42 of the Ghana Revenue Management Act 2016 Act 915, you are advised to comply with the Authority’s letter of 4th September 2017.”

By Emmanuel K. Dogbevi & Solomon Otu Mensah

Copyright ©2017 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.